Gulf Coast homeowners insurance rates are on the rise

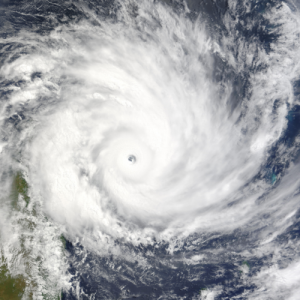

The 2020 hurricane season was characterized by six named tropical storms and a record number of storms. Insurers are trying to limit catastrophe losses by increasing rates for homeowners along with forecasts of an active storm season. Carriers are increasing their underwriting guidelines and limiting their capacity. In some cases, they may even pull out of certain markets. South Florida’s three-county area is seeing rate increases that are especially steep. However, Gulf Coast homeowners who live from Florida to Texas can expect higher premiums and deductibles, as well as fewer wind coverage options.

The University of Colorado raised its 2020 hurricane forecast from the usual 12 to 20 storms after Tropical Storm Edouard became the fifth-earliest named storm. Fay was soon followed by Edouard as the first sixth named storm. This year, the University predicted nine hurricanes, as opposed to an average of six.

After a decade-long hiatus, hurricane activity has increased in recent years. From 2005, when Wilma made landfall in the United States, a record number of Category 4 hurricanes hit the country. In 2017, Harvey battered Houston with record rains, and Maria decimated Puerto Rico. The 2017 hurricane season resulted in a staggering $92 trillion in insured losses. Named storms caused insured losses of $15 billion in 2018. This was primarily due to Hurricane Florence which brought heavy flooding to the Carolinas and Hurricane Michael, which struck the Florida Panhandle with the strongest storm ever recorded. Category 5 Hurricane Dorian was threatening Florida in 2019. However, the majority of the damage occurred when the storm stalled over Bahamas. It caused approximately $4 billion of insured losses and destroyed the islands.

Insurers have become more cautious due to recent catastrophes. This, combined with the drive of Lloyds to increase profitability, has resulted in a reduction in capacity for storm-prone regions. However, it’s not only about catastrophe losses. A large part of the equation is also played by attrition losses. Insurers have had to increase minimum home insurance values or make improvements to reduce potential losses due to increased water claims, especially in Florida and Texas. Insurers base their underwriting decisions on the results of individual properties, so modeling is a more important role. It is harder to get coverage for homes that are not well-modeled.

Homeowners along the coast can expect to pay higher rates, higher deductibles, and more restrictive terms this year.

FLORIDA

South Florida homeowners with low-to-mid-value homes and older constructions are experiencing double to triple rates due to expiring policies. The most affected homes are those in the $100,000-300,000 range, with more market access for those over $500,000 than those below.

South Florida homeowners with low-to-mid-value homes and older constructions are experiencing double to triple rates due to expiring policies. The most affected homes are those in the $100,000-300,000 range, with more market access for those over $500,000 than those below.

In areas where 2% was common, deductibles have risen to 5% and sometimes even 10%. Mortgage lenders are now more open to accepting 10% deductibles. To save premiums, homeowners without mortgages may consider deductibles up to 25%

As more insurers limit their ability to cover wind and other properties, the capacity is decreasing. Some markets have withdrawn completely from the coast. Carriers want to diversify their coverage throughout the state. Capacity is easily available for the Tampa and central Coast areas where rates are lower.

In order to reduce losses due to water damage in low-value homes, some carriers have increased or instituted minimum insured value thresholds. In large markets, minimum insured values have been set at $300,000 to $500,000 and as high as $700,000. These higher-value homes are still a substantial portion of South Florida’s market.

MISSISSIPPI AND LOUISIANA

Rate increases are being seen along the Mississippi and Louisiana coasts. These areas had been relatively spared from tropical storms after Hurricane Katrina in 2005. It remains the most expensive U.S. storm to date. Both states were hit by Hurricane Nate in 2017. However, rates did not change significantly after a long period of quiet.

Domestic carriers have increased their rates. One carrier doubled its rates while another pulled out completely. Mississippi gulf coast insurance agencies cover a wide range of insurance policies, however carriers are tightening their guidelines and limiting their capacity. Mississippi hail and wind deductibles are increasing, with some cases reaching 5%. Carriers emphasize risk mitigation and favor newer construction. Older properties will need to have their wiring, heating, and plumbing updated. Water losses are a growing concern, just like in Florida.

TEXAS

Texas coast property rates can rise by as much as 5% to 25% depending upon age and construction. The capacity is decreasing and carriers are being more selective on barrier islands. Coverage is being driven by modeling results. Admitted markets will only accept newer homes that have wind mitigation features, such as shutters for barrier islands and wind roofs. As insurers are unwilling to cover single-family homes valued below $200,000, lower-priced properties may have a harder time getting coverage.

There is less capacity in areas along the coast where Lloyd’s played a significant part. Some wholesalers and admitted carriers are also running out of capacity, as they hit aggregate limits. This forces them to discontinue writing new policies, or non-renewing existing ones.

Carriers operating in coastal areas are more likely to exclude wind. This has forced homeowners to seek out the Texas Wind Insurance Association which offers wind and hail coverage for Gulf Coast counties. Tier One areas 5-25 miles from the coast have seen a greater number of carriers become more cautious, including Houston’s Harris County.

Even in coastal areas, internal damage to homes is a serious problem. Insurers are trying to limit losses by offering water deductibles for homes older than 15 years.

CAROLINAS

The Carolina coast is seeing an increase in homeowner costs and rates of approximately 5% to 15%. Some areas of North Carolina are experiencing 10% to 25% increases. Underwriting decisions are still influenced by home age and occupancy (primary or secondary) Coastal capacity has been reduced due to decreased model results over the last five years. Admitted markets will only accept newer homes that have primary or seasonal occupancy. The key to pricing is modeling results. Larger homes that were built after 2005 and are valued at over $500,000 for Coverage A, are more attractive to carriers. They typically receive a lower rate.

There is less capacity available in areas along the coast where Lloyd’s played a significant role. The limited E&S numbers of domestic markets that write in the small coastal areas are starting to exhaust their capacity. Some have stopped writing new business. While wind deductibles in most of the Carolinas are at 2%, some barrier islands in North Carolina range from 3% to 5%. As the capacity of the system continues to shrink, deductibles will likely increase due to market limitations and homeowner’s seeking relief from rate increases.